UHD TV production on online platforms

Growth in the production of TV series around the world has faltered over the last two years, for a number of reasons.

The Hollywood strikes shut down production in the world’s most prolific TV market, the US, for most of 2023; the streamers backed by big media groups like Walt Disney, Warner Bros Discovery and Paramount came under pressure from shareholders to stem financial losses and spend less money on new productions; and broadcasters and channels around the world cut their budgets in response to declining audiences and ad revenues.

It is now clear that ‘peak TV’ – the point at which the output of new TV series launched onto the world market reached its zenith - is behind us (Omdia’s view is that 2022 was the year of peak TV), but an increasingly competitive TV market, with streamers vying for consumer’s attention with broadcasters, pay TV networks and smart TV platforms, means that appealing content continues to be produced.

According to a forthcoming report from Omdia, the biggest global streamers increased their output of original films and series in 2024. Netflix released 2,867 hours of first-tun content, up 5% on the year before, Amazon Prime Video launched 857 hours, up 33% on the year before, and the output of new content on WB Discovery’s Max doubled to 214 hours.

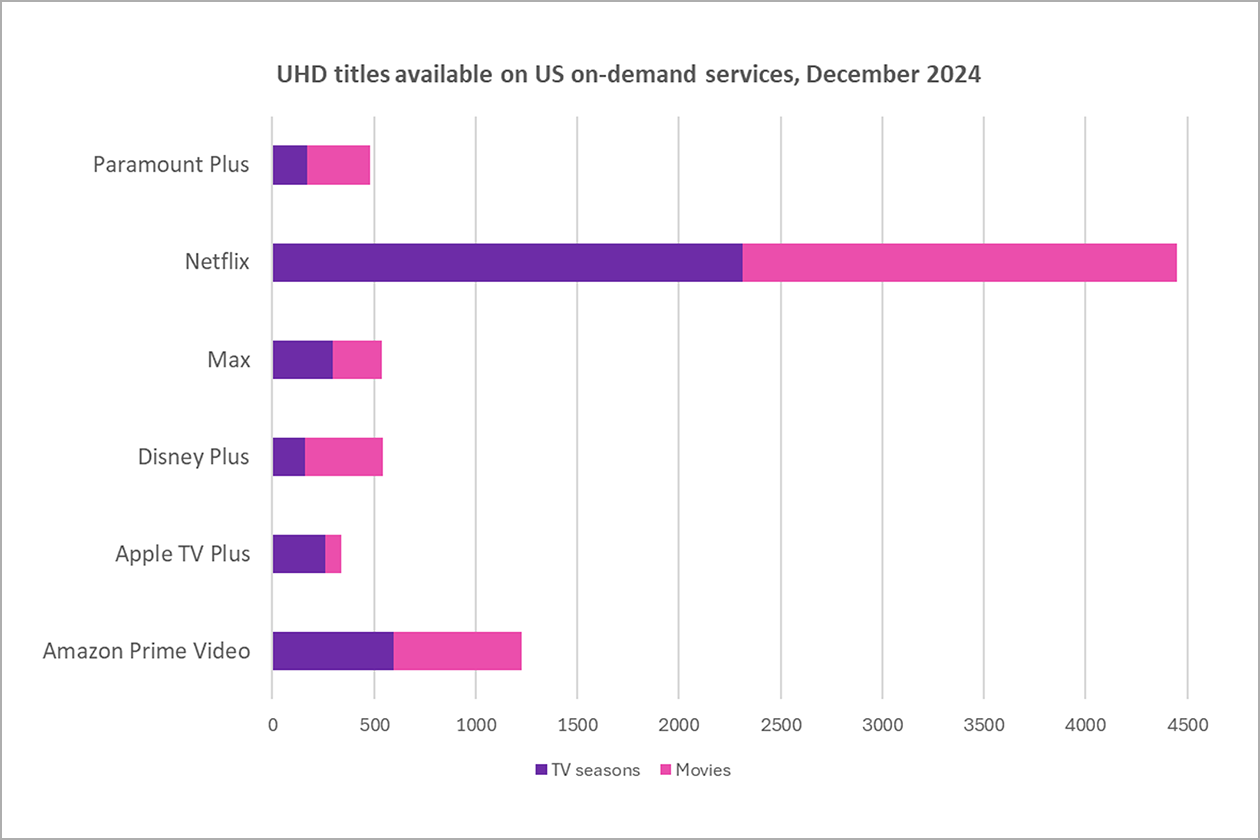

With the average screen size of new TV set shipments now a hefty 50 inches (127 cm), high quality image quality is a key feature. In December last year, according to data from Omdia’s partners JustWatch, Netflix offered by far the largest number of UHD titles in the US, with 2,134 movies and 2,315 TV seasons on offer. Amazon Prime Video, with the next largest offering, offered 628 movie titles and 596 TV seasons.

The importance of UHD in the line-ups of Netflix and other players is clear if we look at the pricing of its various subscriptions. In the US, a Netflix Premium Tier costs $24.99 a month and includes 4K Ultra HD Streaming along with HDR and Dolby Atmos and allows four devices to watch at the same time. The cheaper Netflix Standard and Netflix Standard with Ads offer 1080p Full HD and allow only two devices to stream at the same time. Netflix requires all of its original productions to be shot in 4K UHD, specifying the use of cameras with a resolution of at least 3,840 horizontal photosites.

The Netflix Premium plan is the most expensive SVOD service currently available (which seems justified given Omdia’s findings about catalog size). However, most SVOD platforms adopt a similar pricing approach in making 4K UHD a feature of their premium tiers. On WB Discovery’s Max service, a Premium plan costs $21 a month and includes Ultra HD, while Standard packages range from $9.99 a month (with ads) to $16.99 a month (no ads) and do not include UHD. Warner Bros was one of the early movers into 4K UHD for TV series when it released Westworld and Game of Thrones in the format in 2018. Paramount+ with Showtime is the top-tier offer from the US studio costing $12.99 a month with 4K UHD, compared to $7.99 a month for Paramount+ Essential which is HD-only.

Channels featuring UHD 4K content have not been quite as transformative as HD a couple of decades ago, but they are a key part of many subscription channel offerings around the world. Sports channels are the most common content genre, with Canal+ and SFR Sport available in UHD in France and TNT Sports Ultimate and Virgin TV Ultra in the UK and Ireland.

As streamers continue investing in UHD content, HDR has become a crucial enhancement for delivering superior image quality. Globally, streaming platforms support multiple HDR formats, with Dolby Vision and HDR10 widely deployed across services like Netflix, Disney+, and Apple TV+. HDR10+, which builds on HDR10 with dynamic metadata, is supported by Amazon Prime Video and was recently adopted by Netflix. In China, HDR Vivid, designed to optimize brightness, contrast, and color accuracy, has gained significant traction, with Tencent Video and iQIYI producing thousands of titles in the format. UHD and HDR play a key role in regions where mobile and smart TV consumption dominate, offering a more immersive experience aligned with growing consumer expectations. The rapid adoption of UHD underscores its role not just as a technical upgrade but as a strategic differentiator in an increasingly saturated streaming landscape.

Omdia’s consumer research also underlines the strong appeal of 4K UHD for certain video services. Asked what factors they consider important in a TV service, rated on a scale of 1 to 5 where 5 is ‘very important’, 49% of consumers said they rated UHD content as 4 or 5. Other factors like price and library size scored more highly. However, among Netflix and Amazon Prime users, the importance of UHD jumped to 58%, and was even higher for users of Samsung or LG TV sets: 75% and 74% respectively.

Despite the slowdown in overall TV series production, the landscape remains fiercely competitive, with streamers strategically ramping up original content and prioritizing high-quality viewing experiences. The continued emphasis on 4K UHD, particularly within premium subscription tiers and among users of advanced television sets, underscores its growing significance as a key differentiator in attracting and retaining viewers. While "peak TV" may have passed, the pursuit of captivating content, coupled with the delivery of superior visual fidelity, will undoubtedly shape the future of television consumption.

Source: Omdia/JustWatch