Summer Sports UHD Medal Table

The summer’s sports coverage has been the first conclusively post-pandemic. We are back to normal (even if events such as the Tour de France saw riders with COVID infections). We can now take stock of the state of UHD.

Gold Medals are awarded to France and Spain: both have used terrestrial broadcast changes to trigger free UHD channel launches. Both now have permanent free UHD channels from Public Service Broadcasters on terrestrial, satellite and IPTV. What is also commendable is the inclusion of HDR and immersive audio to offer a rounded ‘beyond HD’ experience.

A silver medal goes to India, with an impressive streaming offering from Jio with coverage of twenty events concurrently in UHD. Jio offered more simultaneous choice than almost any service.

The Olympics always receives less interest in the US – in part because of the strength of its local sports culture. At the same time service delivery has always been pragmatically focused on profitability rather than technological flagships. With US television providers generally sceptical about the commercial merits of UHD, the Olympics saw convincing progress compared to past events. US TV providers focused on the biggest impact: HD-HDR was the way to go. It is also worth remembering that while 1080p may not seem impressive, it still offers a significant improvement as much HD has been broadcast in 1440x1080i. 1920x1080p is an improvement especially with the removal of interlacing from fast-moving sports content.

Germany is an outlier in Europe with no UHD Olympic coverage at all from national broadcasters. This repeats the trend from the Euro’24 football tournament, hosted in Germany, where no UHD feed was available to overseas broadcast partners. Capture was HD-HDR. Despite German consumers buying some of the largest and highly featured TVs in Europe, the largest TV providers are reluctant to invest. On the other hand, it could be concluded that Germany (like the US) is focusing on maximising its return on investment.

Linear broadcasting passes the baton to the streamers.

In all regions, Streamers have used their different delivery cost structure to offer wider coverage, both in choice of sports and UHD options. It also reflects the decline in linear TV audiences and revenues, with the result that streamers have often out-bid the others for top-tier rights. Streamers are also better able to offer coverage of more niche sports.

8K: special events but TV shipments remain tiny.

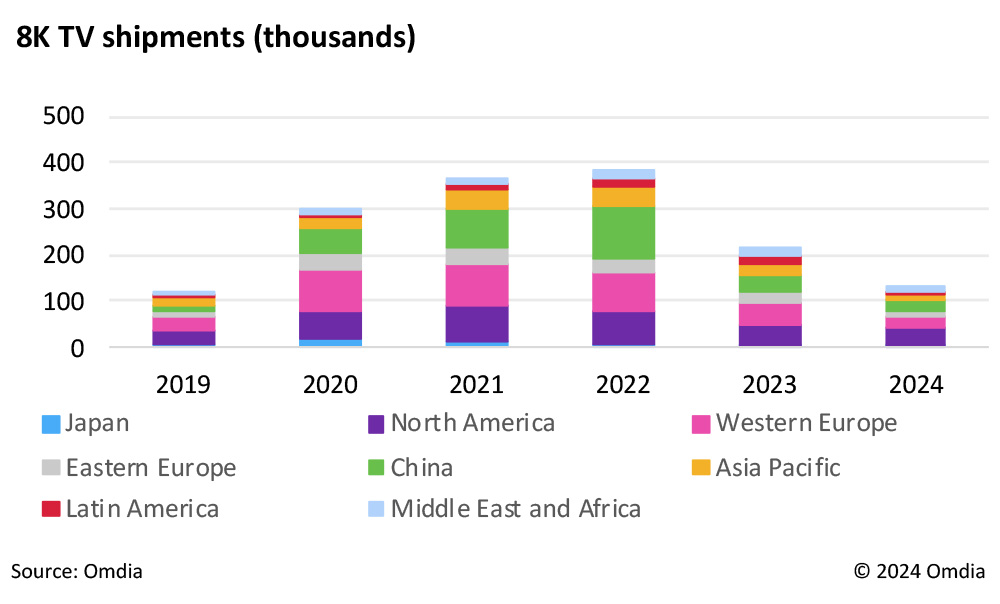

China and Japan again offered some 8k coverage. This remains an engineering exercise. Shipment of 8k TV sets continues to falter. With only 214k shipped worldwide in 2023 – with only 39k in China and 3k in Japan it is far from being a commercial prospect. Indeed, the vast majority of 8K sets are sold by Samsung which is not present in Japan and has only a small position in China. By comparison, over 480k 98” and larger 4K sets shipped globally in 2023.

If the LCD panel makers’ dream comes true and 85”+ sizes (XXL TV) become the norm then there will be room for a resolution increase to 8k at a future date, probably after 2030. Such a move will require a degree of vision and appetite for risk from TV providers, something not favoured by the current investment climate. The original 8k roadmap from the BBC and NHK considered 2030 as the likely start date for commercial 8k services, and this still looks like a sensible timeline.

In Summary

Overall, the Olympics demonstrated a steady gain in UHD coverage and availability. The different economics of streaming, without the heavy fixed up-front investment in spectrum continues to help its growth. But simultaneously we see broadcast UHD also making progress, especially in Europe. Even UHD-sceptics (such as the US and Germany) are adding UHD elements such as HDR which maximise the impact with low extra costs. UHD was never just a resolution story, and this continues to be the case.